Inside finance transformation: Priorities, pitfalls and practical advice

Organisations can no longer afford to delay finance transformation — the cost of inaction is growing. But what does that transformation really look like in practice, and where are the real barriers?

To find out, we ran a series of pulse surveys on LinkedIn, asking our network of change professionals to share their experiences. The results reveal a finance function under pressure to modernise, but not always set up for success.

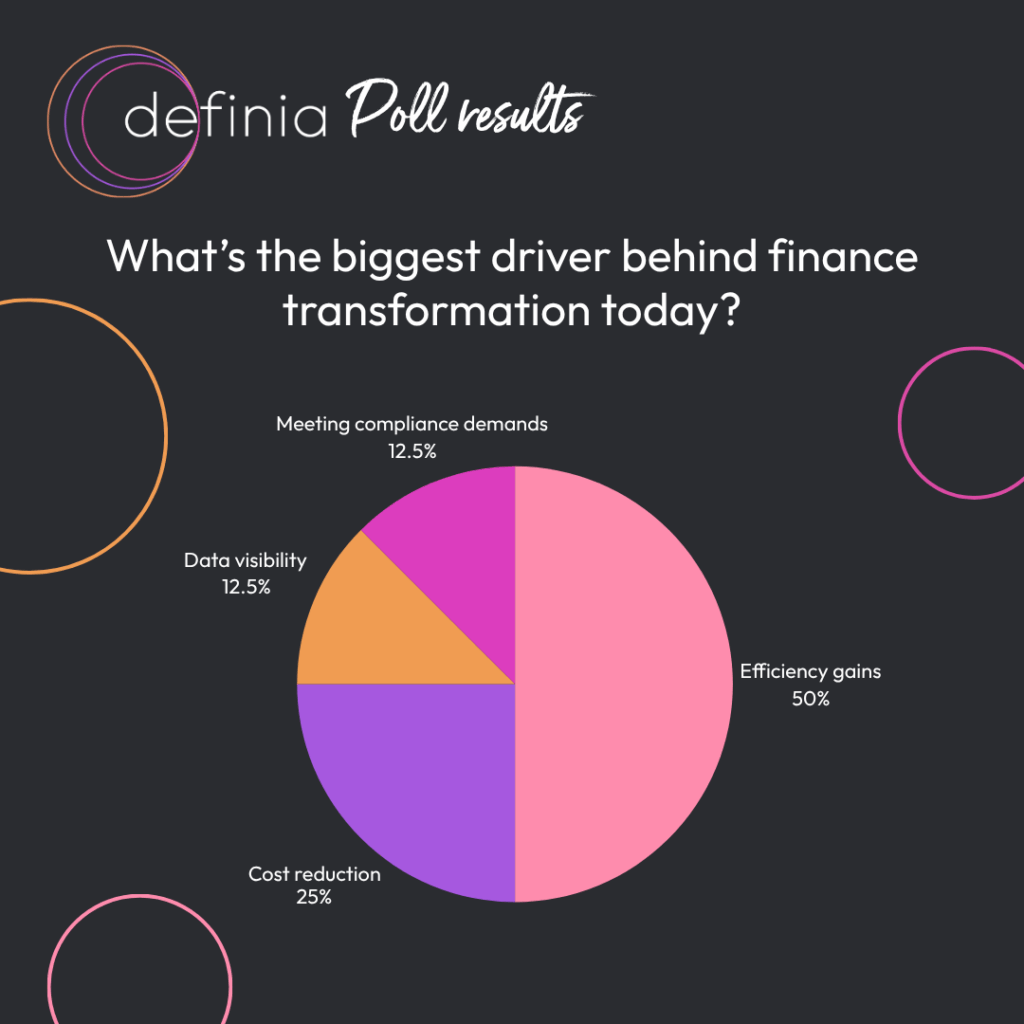

Efficiency is driving change

Half of respondents pointed to efficiency gains as the main driver behind their transformation efforts. Cost reduction followed, with data visibility and compliance each cited by a smaller share.

This is no surprise. Recent data echoes this, finding that 67% of finance leaders ranked operational efficiency as a priority. However, in many organisations, legacy systems and manual processes still dominate — limiting the finance team’s ability to move quickly, manage risk or deliver timely insights.

Efficiency is no longer just a nice-to-have. It’s a route to resilience.

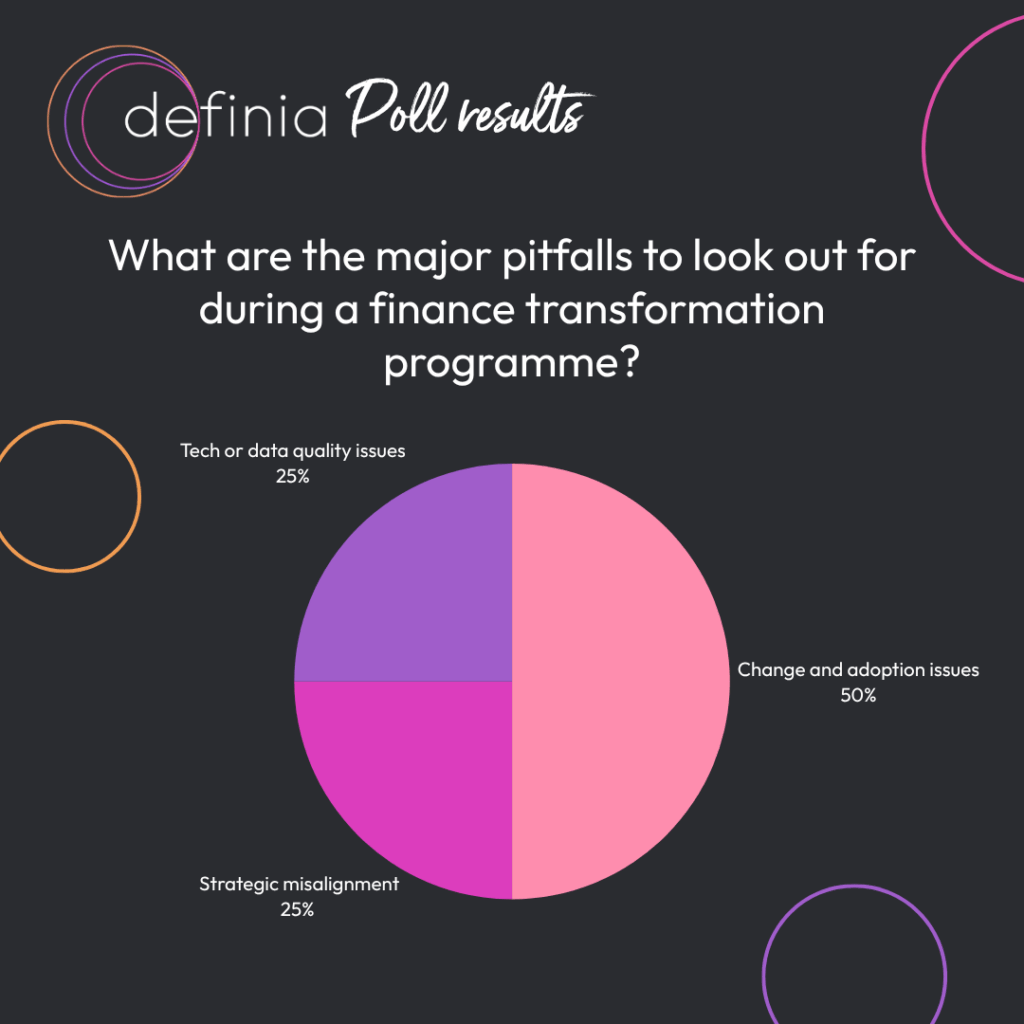

The biggest risks are human, not technical

When asked about the most common pitfalls in finance transformation, change and adoption challenges came out on top. Strategic misalignment and tech or data quality issues followed.

Technology may be the most visible part of a transformation, but it’s rarely the most difficult. Even when the will to transform exists, internal resistance and cultural inertia often hold organisations back. The real test lies in aligning stakeholders, embedding new ways of working and keeping the business-as-usual work on track during change.

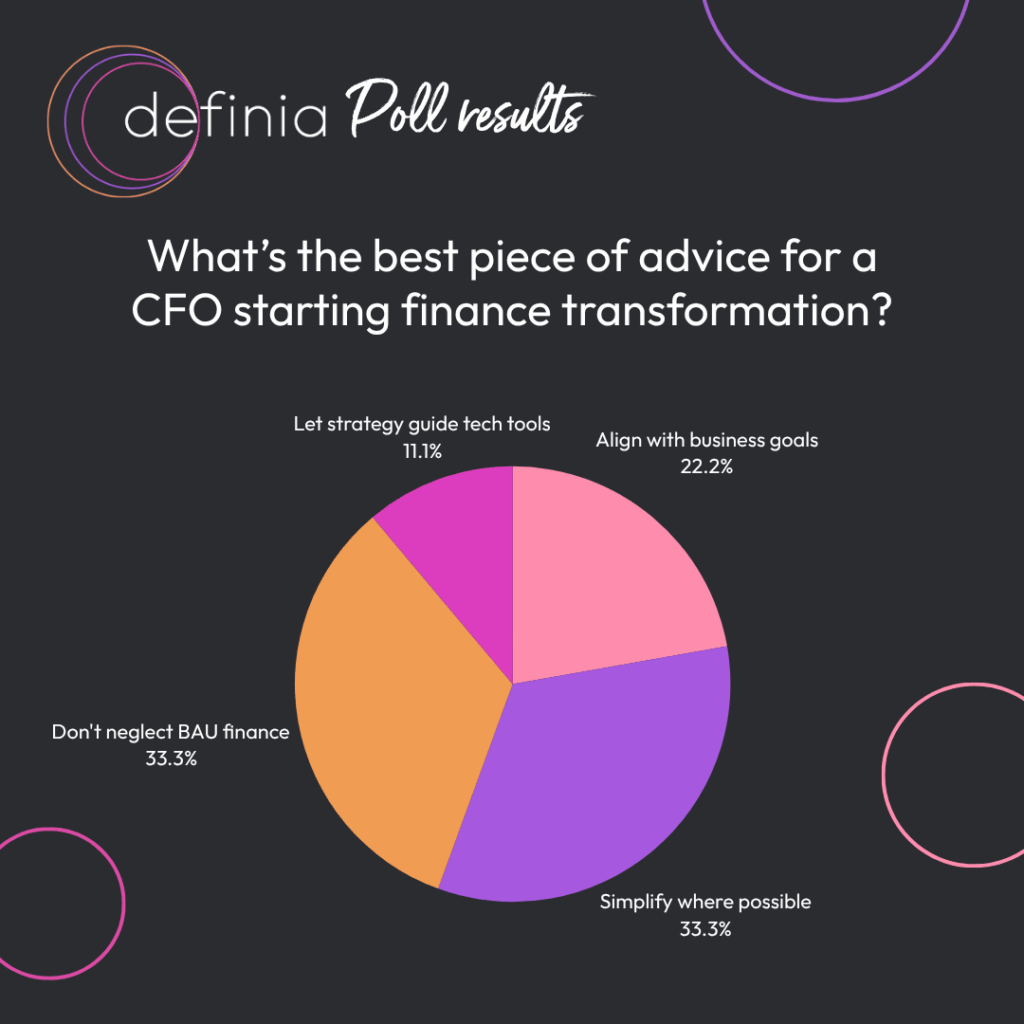

Advice for CFOs? Simplify, stay aligned and don’t lose sight of BAU

Respondents were evenly split on the best advice for those embarking on transformation. A third recommended simplifying wherever possible, while another third emphasised the need to protect business-as-usual. Others highlighted the importance of staying aligned with broader business goals and letting strategy, not technology tools, lead the way.

Executed well, finance transformation is strategic and enables smarter, faster decision-making — but organisations must maintain a delicate balance between innovation and operational stability. It’s not just about systems or structure; it’s about making confident progress while delivering on today’s demands.

Partner with Definia

Transformation doesn’t happen in isolation. It requires clear priorities, committed leadership and a partner with real-world experience and deep understanding.

At Definia, we help organisations cut through complexity by aligning systems, teams and strategy to deliver meaningful, sustainable change. Whether you’re looking to improve efficiency, modernise finance operations or build stronger foundations for growth, we bring the structure and support to make it happen.

Ready to move from intent to impact? Speak to our team today.