Our Services

Future-proofing your business, at your pace

We’re here to help leaders complete complex projects, deliver change, and equip their organisations for sustainable future success. Ultimately, we want to rid the world of failing tech-enabled transformation programmes.

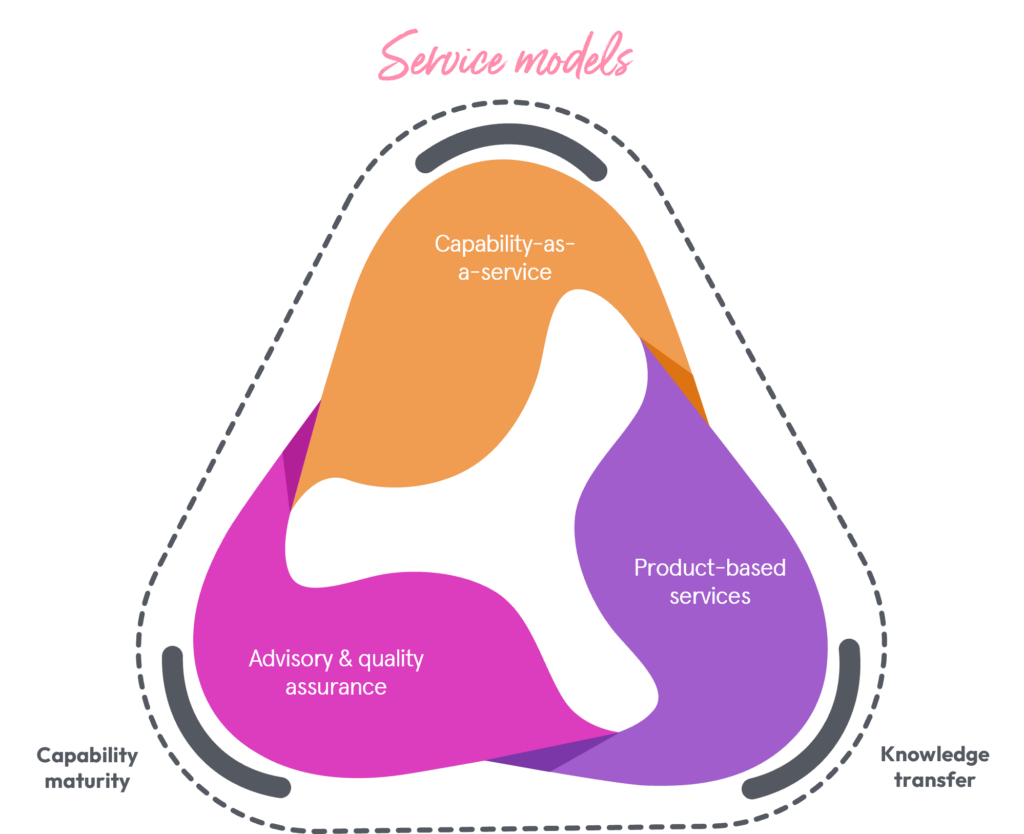

Through our Hybrid Consulting approach, we partner with you to keep your business moving forward at your pace. Whether you require a multi-disciplinary approach with seasoned professionals, agile methods which prioritise adaptability, co-creation seeking your increased involvement, an outcome-focused delivery or capability maturity and knowledge transfer, we Define, Design, and Deliver the right solutions to make it happen.

Strategy & Advisory:

Maturity Assessment

TOM & Org Design

Transformation Assurance

Programme Readiness Assessment

Transformation

Advisory

What does my organisation need to successfully transform?

We are dedicated to understanding where you are, where you need to be, how to align and how to get you there across your entire transformation strategy.

The Definia advisory services are delivered through our ‘Lead Principal Associates’ bringing a wealth of experience as consultants, industry experts, analysts, and technical specialists.

Through customised solutions and roadmaps, aligned to industry best practices and tailored to your business needs, the outputs provide tangible and pragmatic roadmaps to minimise risk and ensure successful change management approaches.

Define. Design. Deliver.

Transformation Delivery

Future-proofing your organisation

There’s no transformation holy grail; no point where you’ve cracked it and can sit back and watch your business grow. The only way to ensure your success is to keep moving forward. Maintaining a future-facing mindset allows you to embrace new technologies, strategies and approaches to ensure the world never leaves you behind. Keeping up is staying ahead.

We’ll work with you to understand, utilise and maximise your strengths, designing solutions that will elevate performance across your business.

Change is not something to be feared; it’s something to be embraced. It’s an opportunity to shift, to improve, to grow. By keeping pace with change and setting your business up to adapt to market conditions, you’re ensuring a growth mindset that gives you the best chance of future success.

Define. Design. Deliver.

Contact us

Want to chat? Pop your details in the form,

and we’ll get straight back to you